OttawaAgent.ca

Ottawa 2025 Rental Market Review

CMHC’s 2025 Canada-wide rental market report crossed my screen last week, and I realised it has been quite a while since I’ve provided an update on Ottawa’s rental market. It has definitely changed over the past couple of years, and one of the big questions I asked myself many times during 2025 as I drove back and forth across the …

Cash For Keys

“Cash for keys” agreements between Ontario tenants and landlords have been receiving a lot of media attention lately. Here’s a link to a CBC article that includes video clips from a segment that ran on The National a few weeks ago, as an example: CBC on Cash for Keys. CBC’s coverage includes everything you need to understand these agreements, why …

Why your friends think real estate is a bad investment.

1. They Don’t Understand Leverage Some of your friends aren’t investment-minded. They may be risk-averse or they espouse an experience-focused lifestyle and spend all their money “enjoying life”. But you also have friends who are focused on building wealth who insist that real estate is not a good investment. Some of these folks take risks that promise huge returns, like …

High Income Property Prices Mean Negative Cash Flow – Buy REITs Instead?

With escalating property prices across Canada (and the USA!), rental income often won’t generate positive cash flow these days. Some “gurus” suggest buying REITs as an alternative to purchasing income properties directly. Are REITs a valid option in the real estate investing game? I explore that question in this video.

Why Are You Looking For A Great Cap Rate?

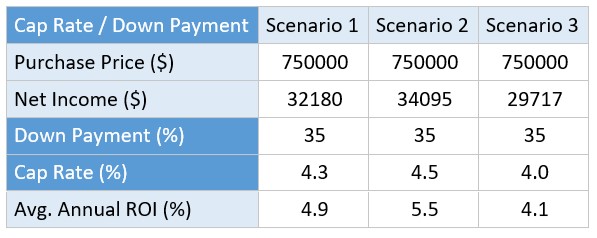

Misunderstanding cap rate, short for capitalization rate, is a favourite pastime of many realtors and novice investors. Too often I witness a lack of understanding of investment analysis within the real estate agent community. My concern is that novice investors may be making purchase decisions with inaccurate expectations for return on their investments. This article examines the relationship between real …

Real Estate Investing: ROI vs. Appreciation

This article is the first in a series examining and illustrating the impact of various factors on the returns generated by a real estate investment. If you remember one thing, let it be that the formula is more complicated than reported in the write-ups for virtually all investment property listings. For example, the “cap rate”, or the cash flow calculated …

Ottawa Condo Prices – Older vs. Newer

Talking about Ottawa condo prices with one of my clients recently, I realised it’s been 6 years since I looked at the average selling price trend for older vs. newer condo apartments in Ottawa. Here’s the article from 2012: Are New or Re-Sale Condos a Better Investment? Fast forward to today; let’s take a look at the average selling price …

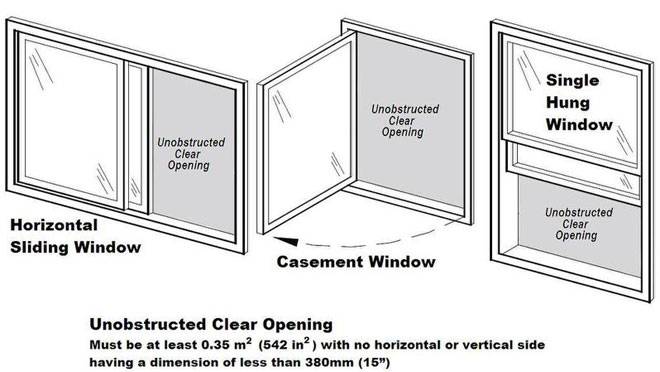

Is That Basement Bedroom Legal?

Basement bedroom window size is an issue that often comes up during home showings and inspections. When buying a home: “Is that bedroom basement legal?” When helping a client prepare to sell their home, the question is, “Can we call this a 3+1 bedroom home?” Does the bedroom in the basement “count”? Is it legal? The answer is… it depends …

Multi-Family vs. Condominium Apartments as Investments

When it comes to building a portfolio of investment properties, there is something on the menu for every taste. To suit your specific tolerances and objectives, you will want to discuss the ins and outs in detail. But I thought it would be fun to write-up a brief table of ingredients for two types of residential properties that are at …

Rules of Thumb – How Far Can They Take You?

A client of mine who is mulling over the idea of acquiring some real estate for investment purposes, started doing some reading on her own and came across a piece about rules of thumb. She read, in addition to other bits of wisdom, that: The rule of thumb is that the purchase price of investment property should be 10 times …

- Page 1 of 2

- 1

- 2