Real Estate Investing: ROI vs. Appreciation

This article is the first in a series examining and illustrating the impact of various factors on the returns generated by a real estate investment. If you remember one thing, let it be that the formula is more complicated than reported in the write-ups for virtually all investment property listings. For example, the “cap rate”, or the cash flow calculated by subtracting one year’s expenses from one year’s rental income, do not represent your expected ROI.

Let’s walk through a quick demonstration of the impact on ROI of average annual capital appreciation of a typical property. I choose to explore appreciation first because it is the most visible and most commonly sought indication of whether or not a property is a good investment. In my books, banking on appreciation for returns is speculating, not investing. Do we try to acquire properties that are likely to increase in value? Do we look to buy in transitional (up-and-coming) areas or blue chip areas with a long history of above-average appreciation? Of course we do. Appreciation is gravy. It’s a bonus. Often a huge bonus. Do we secretly know that appreciation is what will most likely make our properties blow other investment vehicles out of the water? For sure. But relying on appreciation for returns is still speculating.

For the analysis below I’ve used a canonical urban bungalow with a secondary dwelling unit as the sample property. Please note that the ROI results and every other measure in this analysis will be completely different for other properties. That’s actually the whole point of this article and others in this series.

Vital Signs

The vital signs for this sample property (which don’t have any bearing on the point that the results illustrate):

- Ottawa Urban Bungalow offered at $529,900, purchased for $541,000

- 20% down payment, conventional mortgage

- 25 year amortization

- Year 1 property taxes $4,076 (I used a real property for this analysis)

- Year 1 property insurance $1,600

- Year 1 annual maintenance budget $5,000 (no listing you see from any agent will include this – i.e. I’m being painfully realistic)

- Year 1 heating cost $1,800

- Year 1 water bill $800

- Tenants pay the hydro bill.

- Upper unit rent in year one $1,800

- Lower unit rent in year one $1,200

- 5% vacancy rate

I ran an ROI analysis through the OttawaAgent Property Analyser with the mortgage interest rate fixed at 4% for three time horizons: 5, 10, and 15 years. Setting the average annual appreciation at 0%, 1%, … 6%, the resulting total average annual return on investment is tabulated below.

Observations

- this property has positive ROI in the first 5 years at 0% appreciation (even while investing $25,000 in maintenance!)

- higher appreciation over a longer hold time can result in a lower total return on investment if other factors remain constant (rental income for example)

- cap rate does not measure ROI!

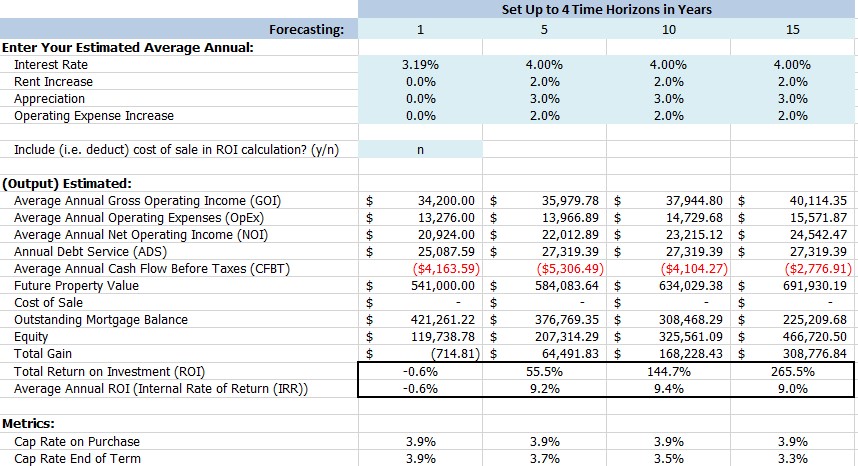

For the above analysis I left the rental income and operating expenses flat for the entire time frame. That is not realistic, but allowed us to assess the impact of appreciation on its own. Below is a screen shot of the results with an annual average increase in rental income and operating expenses of 2%. Operating expenses include property tax, maintenance, and everything else listed above under “vital signs”.

Observation

- the average annual cash flow before taxes for this property is negative in every case, yet the total average annual return on investment is over 9%

There are always many assumptions, and the whole point of this exercise is to illustrate the importance of fully analysing the parameters of your property purchase. When we work for you to help you acquire investment properties, we work together to assess the property physically, it’s location, tenancies, and more. We run the numbers with a variety of parameters and arm you with the information you need to select the right investment property for your objectives and tolerances.

A few additional assumptions and caveats in the above analysis:

- no income tax or capital gains tax implications, positive or negative, are considered

- cost of sale of the property is excluded from the total average ROI calculation for each time horizon – the assumption is you do not sell the property – we calculate the increase in value of your portfolio; you have options for accessing your wealth: refinance, sell, leverage, create trusts, transfer to your children, etc.