OttawaAgent.ca

Why your friends think real estate is a bad investment.

1. They Don’t Understand Leverage

Some of your friends aren’t investment-minded. They may be risk-averse or they espouse an experience-focused lifestyle and spend all their money “enjoying life”. But you also have friends who are focused on building wealth who insist that real estate is not a good investment. Some of these folks take risks that promise huge returns, like buying cryptocurrencies or investing in business ventures. Others are cautious investors with diverse portfolios, usually grounded in the stock market.

These good people will present you with historical data proving that the stock market outperforms real estate, QED. Why deal with tenants, renovations, snow removal and what have you, when stocks are hands-off (though they will advise you to research before investing in individual stocks, or they will recommend index or mutual funds) and perform better over time than real estate anyway?

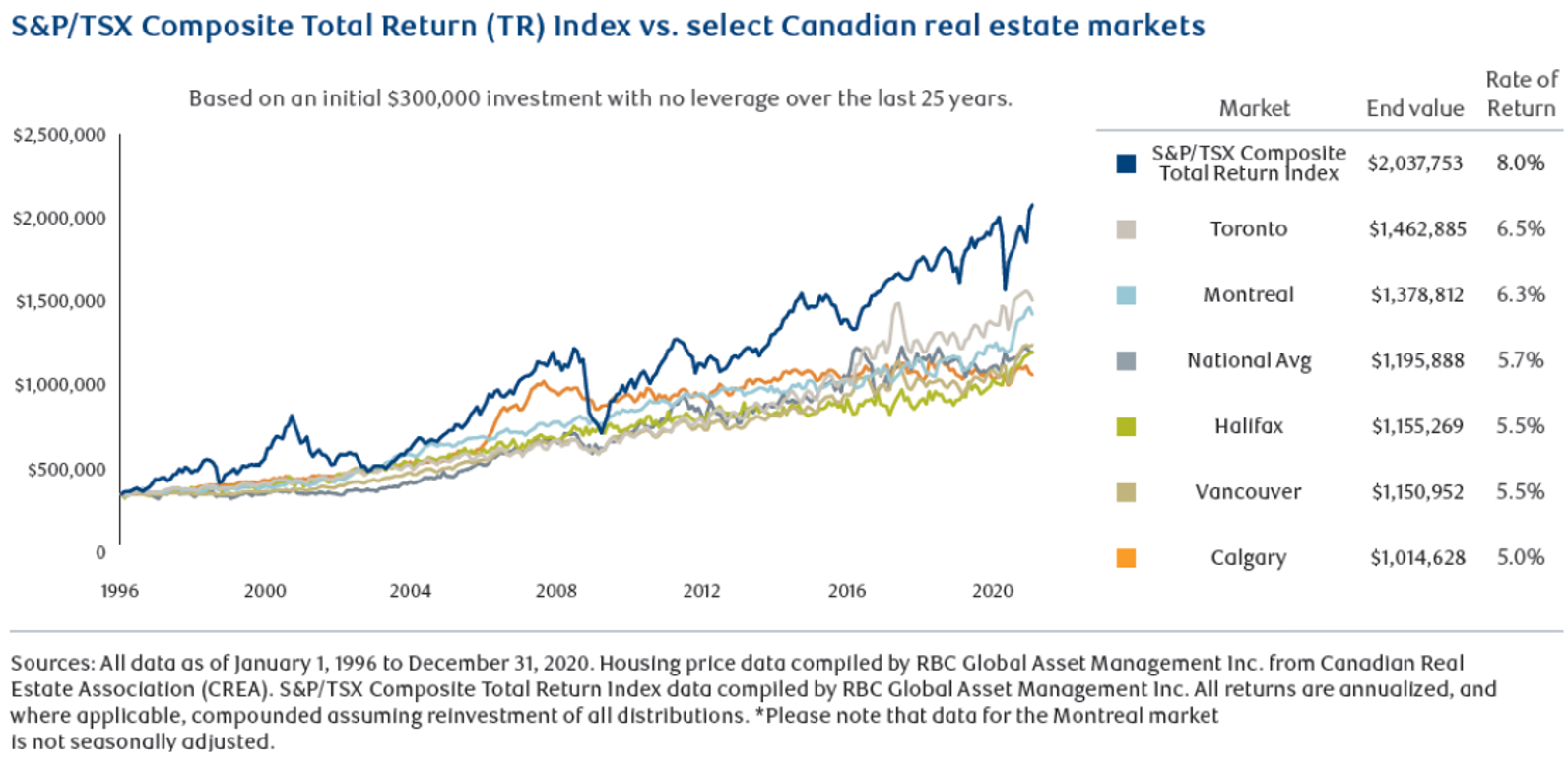

They have a point, don’t they? Here’s the graph:

It’s pretty clear – the S&P/TSX index since 1996 has climbed higher than the real estate market in every major city in Canada. There were a couple of points in time when the value of your 1996-invested dollar dipped into real estate territory (1999, 2003, 2009, 2010) but look how far ahead you are now.

What your friends fail to understand is one key sentence printed right on their graph, just under the title:

Based on an initial $300,000 investment with no leverage over the last 25 years.

And there you have it. With no leverage. Your dollar invested in stocks grows your wealth in two ways:

- Appreciation

- Dividends

Your dollar invested in real estate grows your wealth in 5 ways:

- Leveraged Appreciation

- Cash Flow

- Principal Paydown / Equity

- Restructuring Leverage / Tax Advantages

- Hedging Inflation

A quick Google search finds numerous articles explaining the ways that your dollar invested in real estate makes money. People use a variety of terms and explain things differently. Read a few and you’ll get the picture:

I may write an article explaining the ways real estate holdings produce returns, but today we’re talking about Leverage because not counting leverage is the first reason your friends think real estate is a bad investment. Let’s use the above graph to explain the impact of leverage. The premise of the graph is that an initial investment of $300,000 in 1996, had you put it into the S&P index, would today be worth $2,037,753, whereas if you’d invested it in Halifax real estate would be worth $1,155,269. With no leverage. What does this mean in real life?

The implication is that you would have paid cash for $300,000 worth of real estate in 1996. Most likely that would equate to one property, but you may have purchased two properties at an average of $150,000 each. For the math, it makes no difference. The key is that you paid cash – that is, your investment was not leveraged. That’s how you would have bought the stocks too. This all assumes you had $300,000 cash to invest. Like most of us did in 1996, amirite?

Who invests in real estate this way in the real world? Nobody. Real estate is the one asset you can, and in fact are expected to leverage. To buy that $300,000 house you could have spent as little as 5%, or $15,000 up front. For argument’s sake, let’s say you had purchased one $300,000 Halifax home with a 20% down payment, or $60,000.

The graph shows your average annual return to have been 5.5% over the ensuing 25 years without leverage, whereas if you’d invested in the S&P index, you would have realised an average annual return of 8.0%. However, you leveraged your investment. You only invested $60,000. But you still benefit from appreciation on the full $300,000 value of the property.

Let’s do the math to compare returns. There are different ways to calculate the rate of return – I don’t know what method the creators of the above chart used, but we need to use a consistent method so I’m going to calculate the internal rate of return for each investment using Excel’s XIRR function.

- The S&P index grew $300,000 to $2,037,753 over 25 years, yielding an IRR of 7.64%.

- The Halifax house paid in cash grew $300,000 to $1,155,269, yielding 5.32%

- The Halifax house bought with an initial investment of $60,000 grows to $1,155,269 minus the $240,000 that was borrowed, yielding 11.04%

Of course, if your purchase was leveraged, that means you had to make mortgage payments for all of those 25 years. You also wouldn’t owe $240,000 after 25 years.

The mortgage payment and other expenses associated with owning the property are a red herring, because we are not talking about your principal residence if we are comparing real estate to the stock market as an investment. Your principal residence may come out ahead, but the fact is your principal residence is not primarily an investment. In my books, it’s not an investment at all. It’s an asset, but it is your home and whether you rent or own your home, your costs are written squarely into the household expenses column. The lifestyle leger. The cost of living budget. Owning your own home has proven over time to create forced savings in addition to the benefit of owning an appreciating asset. But it is not “an investment” – owning your home does not make you a real estate investor.

We are talking about investing in real estate. This means that, invested prudently, other people will be making the mortgage payments and covering all the other expenses directly related to your investment (property tax, utilities, etc.).

- The Halifax house bought with an initial investment of $60,000 grows to $1,155,269 that is all yours if someone else is making the mortgage payments for you. Yield: 12.04%

These calculations illustrate and isolate the impact of leverage on your rate of return. Maybe your friends understand this much. Maybe they feel there is more risk in that 12.04% per year than in the stock market’s 7.64%, or that the stock market is better because it requires less work than owning and managing a rental property.

Fair enough. But what your friend misses is the life changing impact that leverage makes on the absolute value of your wealth. Remember, the graph assumes you had $300,000 to invest. If you invested it in stocks, you’d end up with $2,037.753 after 25 years. What if you invested it all in real estate? With leverage, you only invested $60,000 to acquire that $300,000 asset, which grew to $1,155,629. But the premise of the comparison is that you had $300,000 to invest. That’s five times $60,000. To invest it all in real estate, you’d buy five such properties and each would grow to $1,155,629.

After 25 years you’d own $5,778,145 worth of real estate. Do your friends understand this?

2. They Are Afraid

Investing in index or mutual funds doesn’t require a lot of courage. Yes, the stock market goes up and down, but no one disputes that over the long haul it trends upward and you are unlikely to lose money investing in essentially the entire economy long term. Fear often lies underneath the claims that stocks yield higher returns than real estate. Some of your friends may know that real estate returns far exceed stock market returns in the full analysis, but there is plenty to fear in real estate investing:

- Tenants destroying your property.

- Tenants not paying the rent.

- Tenants constantly complaining.

- Landlord-unfriendly regulations.

- Manual labour required to maintain the physical asset.

- Acquiring the wrong properties.

- Difficulty choosing locations.

- Difficulty screening and contracting with tenants.

- So many associated costs: loan/mortgage interest, property taxes, utilities, repairs, maintenance, advertising, accounting.

Investing in an index fund is definitely less scary. But that is why, and proof that, the rewards of investing in real estate are orders of magnitude higher. If you’re going to invest in real estate, you will need to commit to understanding all aspects of managing your investments and working toward mastering them. Tons of people less talented than you have managed to successfully invest in real estate and become very wealthy. You can do this.

Real estate is not complicated. Being a real estate investor is down-to-Earth business dealing with properties and people. With a professional, firm but friendly, unemotional, practical approach there is nothing to fear. The key is to avoid trying to cut corners or defeat regulations, accept the risks and bumps that occur along the road, use best practices, and play the long game.

Remember that you have more control over your real estate investments than you can ever hope to have over the stock market. If you think real estate is too much work or too difficult, I suggest you reconsider how well you understand corporate finances, macro-economic trends, stock and dividend allocations. It never ceases to amaze me how many people are more afraid of houses and people than they are of corporate governance and multinational business logistics.

3. They Fixate on Year One Cash Flow Or “Cap Rate”

Most residential and multi-residential investment property listings provide a statement of income and expenses for one year of operation and make “profit” claims based on the resulting net income or the calculation of capitalization rate based on that pro forma net income against the asking price of the property.

Many people who want to invest in real estate, and some who have a small portfolio of investment properties already, also focus on year-one pro forma net income or cap rate in assessing whether or not to acquire a property.

This overly simplistic approach will set you further down the wrong path than any other factor in real estate investing. As an example – go back and review the first item in this list, “They don’t understand leverage”, and consider: what’s the cap rate of the 5 Halifax properties purchased in the example? If I tell you the cap rate was 4% or 7%, does it change your assessment of whether those properties were a good investment?

Selecting quality properties for your portfolio requires taking more factors into consideration. For example:

- Does the property require further investment in repairs or renovations within the first 5 years?

- How do the rents in the seller’s income & expense statement compare to fair market value rents for the dwelling unit or units in the property?

- What developments are planned for the immediate area surrounding the property?

- What is the typical economic demographic of the tenant base in the area?

- Do the seller’s financials include vacancy rate, advertising, snow plowing, pending property tax changes, a reasonable property maintenance budget?

- Does the property’s use comply with current zoning bylaws? If not, did it comply when constructed?

- Are there ongoing disputes with any of the tenants?

- Does the property meet current fire code requirements? What will it cost to remedy?

- With everything factored in, including financing, what is the projected total internal rate of return over various time horizons?

4. They Think Properties Are All Over-Priced Right Now

This sentiment equates to trying to time the market, whether you’re investing in real estate or stocks. It’s unlikely you will be the first person in history who is able to time the market reliably. Waiting for perfect market conditions will always cost you – opportunity cost is real. I have yet to meet anyone who looks back more than 5 years and sighs, “whew, I’m so glad I sold that property when I did”. It can happen; there are times when exiting makes sense; but the missed opportunity to acquire a property or the regret about disposing of a property is more common than the opposite.

Think about that observation. It means that even when people have potentially paid a little more than they should have for a property, or they paid a fair price but the property had problems that had to be corrected, people generally feel the smartest path is to hold onto properties.

The key in acquiring an investment property is not to try to time the market, but to properly and fully assess each individual opportunity in the context of the current market and indicators of market momentum. In some market conditions in any given location there are more or fewer opportunities that pass scrutiny, but there are always some. It is never true that “all properties are over-priced”. If any properties are selling; if transactions between willing buyers and sellers who are not under duress are occurring, then by definition, there are properties that are not over-priced.

5. They Watch Too Many Real Estate Investor Gurus on TV

We’re going to give your friends some credit on this point. The real estate investing shows on TV are unrealistic, and your friends are smart enough to see through the hype. I recall seeing a renovation show that depicted transforming a kitchen for under $500 US. Real estate investing gurus operate syndicated investing seminar programmes that explain how you can buy 10 properties with none of your own cash.

While there are ways to borrow money from sharks, or buy light fixtures for $10 each, none of this represents a realistic path to building a quality real estate portfolio in which you hold any meaningful equity stake. If you’re going to invest in real estate, taking a long term view and committing to the process of gradually building stable wealth is the prudent way to go.

In this case, your friends opt out of real estate investing and recommend you do the same because they are sure that it is all a mirage. One option in the face of nonsense is to walk away. The other option is to dig in, do the research and the work, ignore the false promises of a quick and easy road to instant success, learn the fundamentals and join the ranks of those who’ve patiently built up real estate portfolios that have become the engine of income and base of wealth for individuals and families for generations.

6. They Live Beyond Their Means

Making life style sacrifices today to build a foundation of wealth that will fuel your life and potentially your descendants’ lives forever is a choice not everyone is prepared to make. We are not a patient society and many people want it all and want it now, at any cost.

There are numerous ways you can start your real estate investing journey earlier than you might think, and accelerate it at various junctures to a degree. Those tactics are worth exploring, but the over-riding strategy is one of taking some time. embracing the process, and being patient. Many of your friends would rather enjoy two or three all-inclusive vacations a year and eat at fancy restaurants multiple times a week today at the cost of an uncertain future.