OttawaAgent.ca

Why Are You Looking For A Great Cap Rate?

Misunderstanding cap rate, short for capitalization rate, is a favourite pastime of many realtors and novice investors. Too often I witness a lack of understanding of investment analysis within the real estate agent community. My concern is that novice investors may be making purchase decisions with inaccurate expectations for return on their investments. This article examines the relationship between real estate capitalization rate and return on investment.

This concern is not academic. I meet many people who are dissatisfied with their investments, can only think of divesting, and lose interest in building wealth through real estate not because they lack the requisite skills, financial resources, or personality traits, but because they were misinformed about expected returns from the outset. One of the key touch points of that misunderstanding is advice from agents who equate cap rate to return on investment (ROI).

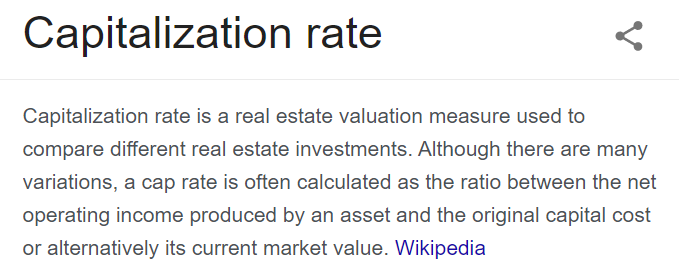

Let’s examine the source of the lack of understanding in the industry. There are industry courses in real estate investing that agents can take. Many who practice in the investment space have not necessarily taken these courses. Some that have may not have aced the math or fully internalized the concepts. Many agents rely on examples from other agents to educate themselves, and thereby misunderstandings propagate through the industry. Another significant source for agents is Google. A quick search immediately reveals a problem. Here are two of the top results defining Capitalization Rate:

I’m not familiar with Investopedia and can’t speak to their credibility. Informed source or not, they’re appearing at the top of the Google search results for me today. And their definition of capitalization rate is simply wrong. Perhaps their definition is intended to apply only to properties that are not financed – properties owned outright. Cap rate and ROI more closely align in that case – but they are still fundamentally different measurements.

While Wikipedia is hardly an authoritative source, their definition is excellent. You could add to the first sentence that capitalization rate is a valuation and risk measure used to compare real estate investments. Note also that within this definition you learn that cap rate does not measure ROI – because cap rate could be calculated using original capital cost, or alternatively current market value. If it could be measuring two different things, it cannot be the same as one thing: ROI. I’m being a bit cheeky here, because you can also mean different things when you say ROI – but you could mean multiple things, which only increases the permutations and combinations of cap rate and ROI.

Real estate appraisers will tell you that smaller multi-family properties are not evaluated purely based on the income approach (related to capitalization rate). Properties with fewer than 12 units are often valued with as much or more weight given to a direct comparison against properties of similar age, size, condition, fit, finish and features.

How’s The Market?

Ottawa Real Estate Monthly

My monthly newsletter is loaded with facts, data, and no-spin analysis.

Like the valuation of businesses in vertical segments, the income approach to assessing the value of investment properties compares the performance of a specific property against an expected capitalization rate for a market segment defined by location, building quality, building capacity or other characteristics. For example, data from hundreds of sales of 40 to 80 unit apartment buildings in North York might support a capitalization rate of 5.6% whereas buildings of a similar size and quality in Laval might be measured against a cap rate of 6.1%.

Cap rate applies to expectations of investments in a particular market segment, and prospective investments can be measured against that rate as one indication of their value, to help inform a purchase price decision. Agents tend to use cap rates in reverse, suggesting that a property generates a cap rate, and worse, that this cap rate equates to ROI.

Note that market segments with higher cap rates suggest greater risk associated with investing in that market.

Here are some quotes from recent multi-family property listings from the Ottawa Real Estate Board’s MLS:

“Current cap rate is high which makes this a no brainier investment.”

- a high capitalization rate indicates a higher risk investment. This could mean it’s more difficult to find tenants, the property is run-down and will require significant further investment beyond the purchase price, the building attracts problematic tenants, or the location is suffering an economic downturn

- I don’t know what “current cap rate” means but I think they mean that the property is being offered at a price based on a cap rate much higher than typical for the market segment

“Fully rented, the CAP RATE yield is an attractive 4.1%.”

- this property was offered for sale fully vacant, so if the price is based on a cap rate of 4.1% it is also based on projected income, so you’d want to do your diligence on market rents, then apply the prevailing cap rate for the market segment to help inform a fair price offer

- the property will not “yield” a cap rate; the current value of the property at any point in time can be estimated using a variety of methods, one of which is applying an appropriate cap rate

“Fabulous Cap rate potential for an investor with no upgrades required.”

- I have no idea what this means. If the property has potential, that suggests the ability to increase net income or that the property is expected to appreciate based on market forces. What is cap rate potential? If I increase the net operating income, the value of the property should increase proportionally – the cap rate should remain relatively consistent; that’s the whole point of cap rates. (If properties in this segment are valued purely using the income approach the relationship between income & value would be direct – but this is not generally the case as these are smaller multi-family properties, so yes the value will increase proportionally with income, but not linearly and not necessarily in keeping with or limited to the prevailing cap rate.)

“GOI is $40,320/yr and NOI is around $29,000/yr, yielding a cap rate of about 5.4% per year.”

- I think what they mean to say is that the asking price is based on a cap rate of 5.4% and net operating income of $29,000/year. The buyer will want to examine the seller’s financials against the buyer’s observation of the property and knowledge of the market to decide whether the stated NOI is reliable, whether the applied cap rate is appropriate, and how much weight should be given to the income approach in establishing fair market value.

“<This property> offers a great return currently and further upside potential to increase your CAP rate once adjusted for current market rents.”

- What they are saying here is that the current rents are well below market but they are asking you to pay a price for the property based on market rents. In other words, based on the income approach to value, the property is over-priced – and they are boldly telling you it is over-priced. However, as noted earlier in this piece, smaller multi-family properties are not evaluated purely based on the income approach. This property might be a beautiful Victorian fourplex in The Glebe, in superior condition, but rented below market to long term tenants. In that market segment, there are plenty of folks who will pay a price for the property based on its value relative to similar homes and small multi-family properties in the area. Even if it means that the property does not generate the level of income it could for the foreseeable future.

Running The Numbers

Fully evaluating a property as a real estate investment includes a thorough look at the physical condition of the property, its macro and micro location, comparable properties that have recently sold, and the local rental market.

You will want to “run the numbers” to get a quick indication of whether or not the property is worth considering. But running the numbers is not a black & white endeavour. For starters, you need to have a firm grasp of your investing objectives. That discussion is outside the scope of this article – I’ll be writing more about investing and you can circle back to my main investing page periodically for more.

For today’s purposes, I simply want to illustrate that running the numbers does not begin and end with the quick calculation of a property’s apparent cap rate. Let’s play with some basic variables using the OttawaAgent.ca property analyser.

Down Payment

When you buy and hold a property for a number of years, your investment returns in at least 3 ways: 1. leverage, 2. cash flow, and 3. appreciation. Number 3 is gravy. If you decide to invest solely based on the potential for appreciation, you are speculating, not investing.

Number 2 usually increases over time as market rents rise and you pay down the mortgage on the property if it is financed. Some of your operating costs will increase over time, but usually in our market, rents grow faster than operating costs. If you have regular income from a job or other source, you might not want positive cash flow from your real estate investment for two reasons: you will pay income tax on that cash flow, and your total ROI may be lower if your cash flow is higher depending on why your cash flow is higher.

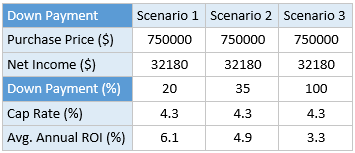

Say what, Bruce? My ROI might be lower if my cash flow is higher? That is correct, depending on why your cash flow is higher. Remember that ROI is the return on your investment. That means, on the amount you invest. The higher the down payment you make, the lower your ROI if the absolute return is the same. Of course, all of the variables are interconnected and therefore the absolute return given different down payment amounts is not the same, but in most cases a larger down payment lowers your ROI because you are reducing the first category of ROI: leverage.

The above table provides an example of the impact of down payment amount on total return on investment. They key is that the relationship between down payment and ROI will differ for every property; you have to do the math – run the numbers – for each specific property. What will always be true, however, is that the amount of your down payment will change your ROI, but will not change your cap rate. Notice the cap rate of 4.3% is the same in the above example, whether you put down 20% or pay cash for the property, or anything in between. Cap rate is not a function of financing, but ROI is. QED. Cap rate does not equal or even measure ROI – at least when the property is financed.

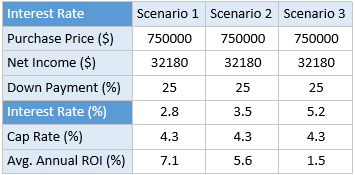

Interest Rate

From the down payment discussion, we’ve seen that financing plays a major role in determining the return on a real estate investment. It is therefore no surprise that interest rate is an important variable.

The above table presents three scenarios for the same property purchased with the same down payment. This property has a cap rate of 4.3% based on the purchase price and stated net operating income. With a 25% down payment, a mortgage interest rate of 2.8% yields an average annual return on investment of 7.1%. Jack the interest rate up to 5.2% and the ROI drops to 1.5%. There are two lessons here; one of them is overt and the other is hiding in the shadows.

The overt lesson is that the interest rate on your investment property mortgage has a big impact on your ROI. In fact, it has the potential to impact your ROI to a greater extent than the calculated capitalization rate at the time of purchase. Yes, you need to pay as much or more attention to the interest rate you can secure as you do the cap rate that the purchase price of the property you select is based on.

Hiding in the shadows is time. For most investors, properties are a long term investment. It is over the long term that you fully reap the benefits of leverage, cash flow, and appreciation. Holding an investment for a long time means that things will change along the way, and the amount of control you have over these changes varies. You don’t have much control over interest rate changes. You can select fixed or variable rates, and the term of each rate agreement. But if prime lending rates rise 5% linearly over the next 20 years, your returns in the last ten years will be significantly negatively impacted.

Do you have more or less control over cap rate than interest rate? The answer to that lies in the quality of your assessment of the property at the outset. Are the stated expenses realistic? Do you see ways you can predictably lower them? Are there factors that you know will increase them?

Will you be able to increase the rental income over time? Are there physical improvements to the property you can make that will attract higher rents, factoring in a full assessment of the local rental market?

My property analyser allows you to forecast the impact of interest rate changes over time.

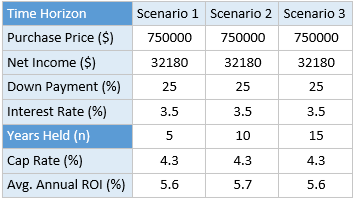

Time Horizon

For the majority of investors, real estate is most beneficial as a long term investment. In most markets, and certainly in the Ottawa market, properties appreciate over time, adding a lot of “gravy” to the more predictable portions of return on investment.

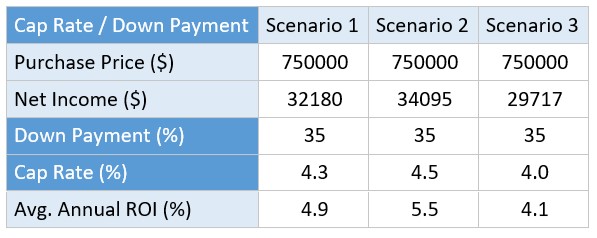

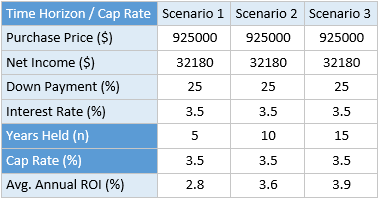

Consider the two tables below, illustrating the impact of time on ROI for the same property purchased at two different prices based on different cap rates at acquisition.

These two tables reveal a couple of interesting facts about the ROI for this particular property:

- Purchased at the lower price of $750,000 based on a prevailing market cap rate of 4.3%, ROI is higher in the first scenario than in the second scenario where the property is purchased at a higher price ($925,000) based on a lower cap rate (3.5%). Yes this is rather ad oculos – pay a higher price, the returns are lower. You don’t need to understand cap rates to figure that one out.

- More interestingly, the impact of hold time on ROI is must greater at the higher purchase price. Regardless of hold time, in scenario 1 the ROI is around 5.6%, but in scenario 2 it varies between 2.8% and 3.9%.

Obviously, if you are comparing paying more or less for the same property, you’ll want to pay less and you’ll accept the fact that your hold time will have less impact on ROI all other factors being equal. These two scenarios serve to illustrate the power of leverage again. Let’s say you’re not looking at paying more or less for the same property (where again, obviously you want to pay less) but rather, you’re considering two different properties that are virtually identical except they are in different locations where the prevailing cap rates differ.

That is, one location is more expensive than the other. Do you still always want to purchase the property at the lower price point, with the higher cap rate, to improve your returns?

What if both properties increase in value over the next 15 years by 30%? Property #1 will be worth $975,000 adding $225,000 to your equity whereas property #2 will be worth $1,202,500 for an equity gain of $277,500. Depending on your down payment and interest rate changes over time, your total ROI will be quite different for these two properties. You need to do a lot of research and play with many more variables than cap rate to make a sound judgement about which property is the better investment given your objectives.

Real Estate Capitalization Rate:

The Bottom Line

If you’re serious about investing in real estate, your bottom line is key. There is purpose and there are rewards beyond your financial bottom line, including the satisfaction of providing quality housing and the accomplishment of building a portfolio to be proud of.

But even if you’re an altruistic housing provider, you can do more of it if your bottom line is richer. Selecting properties for your portfolio involves careful consideration of the market you want to serve, the locations you want to manage, and the returns you expect to generate.

Your ROI is partly deterministic and partly projection and may include some calculated speculative risk. The prevailing cap rate in the market segment you’re investigating tells you a lot about the risk and something about the returns. But if you are being advised to make your purchase based primarily on capitalization rate, you would be wise to break out the analyser, run a bunch of scenarios, put a microscope on the income and expense statements provided by the seller, look closely at the property’s physical characteristics, do your market research, and hire an advisor who will give you more comprehensive guidance; who at a minimum understands what cap rate measures, what it does not measure, and how to apply it.