Ottawa Condo Market Analysis Part 2: Core vs. Outskirts Sale Prices

So the volume of apartment condo sales in core areas of the city relative to the city as a whole was a nice safe place to start, but what you really want to know is how much does location impact value. Well, without charting anything I’m sure you understand that the number one driver in real estate valuation is location, and therefore condos located more centrally are going to be worth more than condos further from downtown.

To recap quickly, I explained in part 1 that the Ottawa Real Estate Board’s condo statistics often quoted in news releases on a monthly basis include sales of every type of residential condominium property – townhouses, terrace homes, apartments, etc. They also primarily report on the city as a whole, and in their case I believe this means the entire area served by the real estate board. This means even outlying towns from Wendover & Rockland to Carleton Place and Almonte and everywhere in between.

I say “I believe” because when I go to the source, the MLS database, for data, the numbers published by the board in their news releases seem to line up with totals for the entire region almost all of the time. Sometimes there are discrepancies and I have not been able to deduce precisely why – it could be simply that they report on a snapshot, but the data for some records changes after the fact.

Anyway, I’m sure I’ve lost some of you with the boring details of data integrity, but I include these comments as a way of ensuring, going forward, that you understand there are discrepancies and could be errors in the OREB reports and in my graphs. But I believe that none of the flaws significantly impact the overall shape of the data.

My definition of the “entire city” ends with Kanata/Stittsville, Barrhaven/Riverside South, and Orleans. I am not including towns and cities outside Ottawa’s city limits. Those markets are very interesting but I think they need to be considered separately.

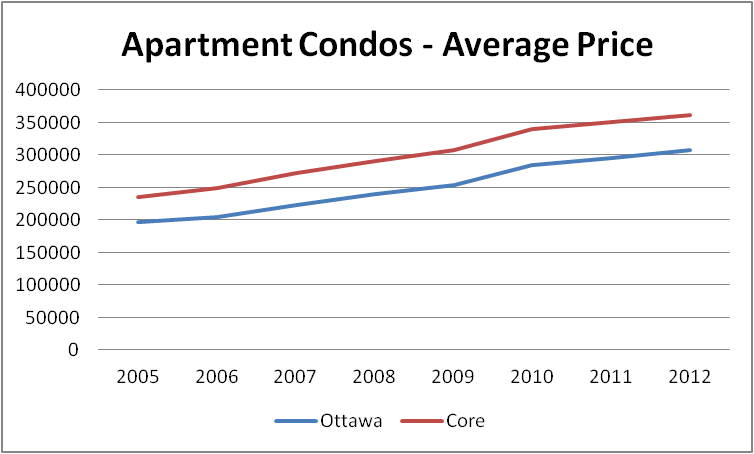

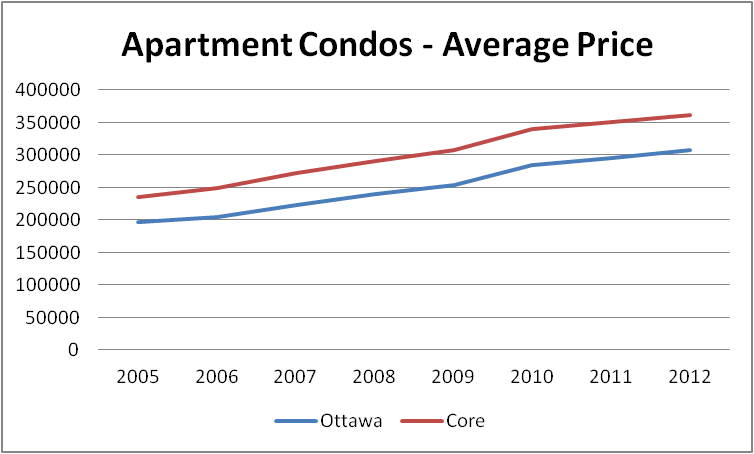

For investors in particular, I think the shape of the curves below is extremely interesting. If you are investing in real estate, what is most important to you? I meet a lot of would-be investors whose pressing question is, “…what property can I buy that will really go up in value?” Of course, banking on appreciation equates to speculating, not investing. Any appreciation must be a bonus – and it’s a bonus you can pretty much count on over the long term in real estate – but if you invest wisely it is just a bonus. But what does this graph tell you? The “core” and “entire city” curves are exactly the same shape! This means it does not matter where you buy in Ottawa, from an appreciation standpoint. Of course, there are a lot of factors to consider in acquiring an investment property – maybe it is easier to find good tenants in some locations vs. others – or maybe the ratio of rents to purchase price differs greatly. There are a lot of factors to consider when selecting an investment property – but for the bonus of pure appreciation – it would seem that location within Ottawa is on the whole, irrelevant.

There are some interesting corollaries of this fact. Perhaps the most interesting one is the prospect of being able to purchase two properties rather than one, for the same price, and thereby greatly improving your vacancy rate and also diversifying in case there are changes in each neighbourhood that do impact rentabilty or property valuation over time.

Lots to think about.

Until next time.