How The Bank of Canada Inflated House Prices

Examining the Bank of Canada’s Interest Rate Policy on Real Estate

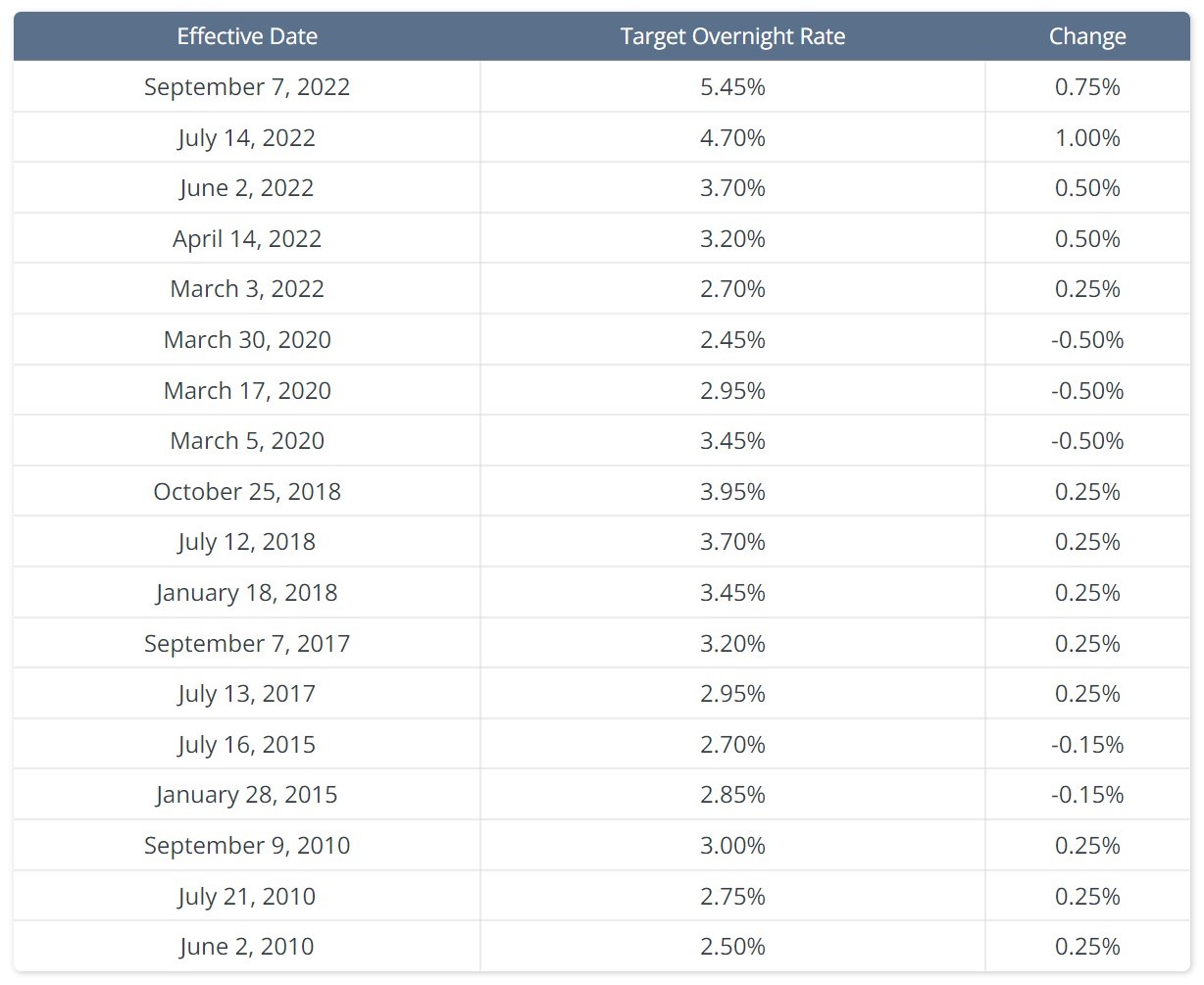

We all know that lower interest rates can contribute to increased demand in the housing market. In this article I’ll look at how the Bank of Canada inflated house prices during the pandemic, from March 2020 through March 2022. When governments announced shutdown measures to start dealing with the pandemic in March 2020, the Bank of Canada immediately dropped it’s prime lending rate by half a point, and followed that with two more cuts of half a point each before the end of that month. This set the base rate at .25% – the lowest on record.

A couple of things to note before we examine the impact of the rate:

- rates had been quite stable prior to these three cuts, with four increases of .25% each between July 2017 and October 2018; leaving the base rate at 1.75% for an 18 month run before the March 2020 cuts

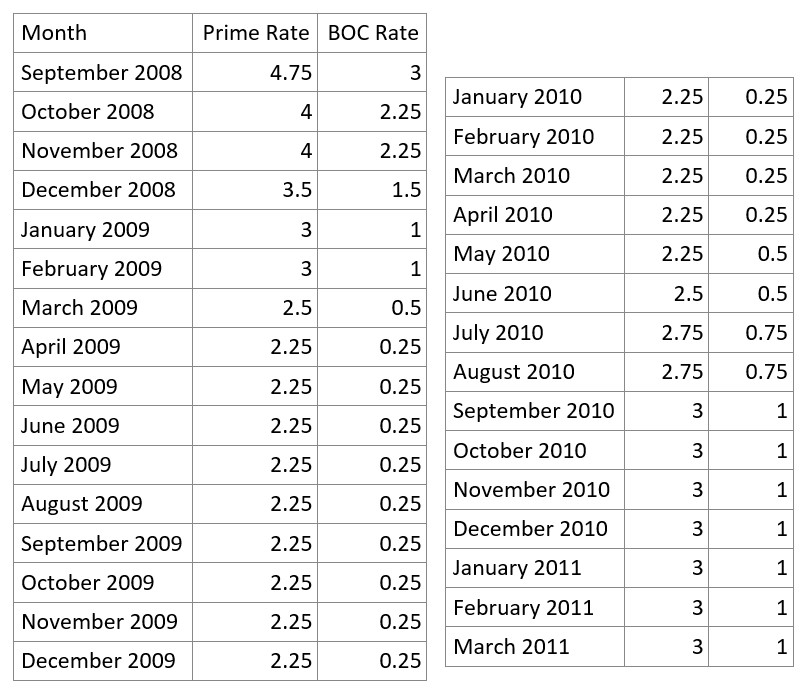

- the .25% base rate reached at the end of March 2020 was not unprecedented – refer to the second table illustration below – the base rate was .25% from April 2008 through April 2009, a full year

Why did the Bank of Canada (BOC) lower it’s policy interest rate to .25% in 2009? You may recall the U.S.A. sub-prime lending and mortgage dealing-led crash of the housing market and broader economy. While Canada wasn’t impacted as strongly because of our more prudent policies, we still endured a recession due to our interdependence with the U.S. economy. The interesting part of the story for us is how the BOC policy impacted the real estate market in 2009 vs. 2020. The short answer is that the market did not spin up into a frenzied seller’s market post-2009. While Canadian house prices did climb steadily from 2008 through 2020, they had already been climbing in the early 2000’s. In Ottawa specifically, the 2000’s saw higher average annual house price appreciation (7.4%) than the 2010’s (3.8%).

My observation: the Bank of Canada’s low policy rate alone does not necessarily create frenzy. There must be other factors combined with the ultra-low rate that caused the almost unprecedented market behaviour we saw from March 2020 through March 2022.

What other factors might have combined to cause the craze?

Let’s look at a few candidates:

Magnitude

Perhaps it’s the magnitude of the policy change – we’ve seen that the BOC policy rate sat at 1.75% for about a year and a half prior to the March 2020 cuts to .25% – a change of 1.5%. But in 2009 when the rate was cut to the same .25% it had fallen from 3% in September of 2008 – a drop of 2.75%.

Speed

Maybe it is the speed of the change. The 2020 cut of 1.5% happened over the course of one month whereas the 2.75% cut in 2008-2009 was spread out over 7 months from October through April. The faster change does correlate with a more intense change in market behaviour, but it’s not clear it fully explains it because the intensity took time to build. The frenzied market didn’t peak until two full years after the rate bottomed out.

Duration

The biggest difference between 2009 and 2020 might be how long the BOC kept the policy rate at rock bottom. I can think of a few reasons holding the rate low so long may have caused the almost unprecedented (*almost – check 1972 – 1974 & 1982 – 1984) run-up in house prices. But after careful consideration and reflection on the statistics and “on the street” market behaviour over the past year, I think this is how it plays out: When the rate bottoms out, people start figuring out how much more they can afford to pay for a house; this effect takes time to build – not everyone acts immediately.

As the number of people realizing it’s a huge buying opportunity increases, homes on the market start to get snapped up and a cycle of more buyers than sellers whips into motion. It may also be that the longer rates are held low, the more people start to believe they will never go up again, creating a false sense of security in spending closer to the maximum they can afford. The longer the rate is held low, the more momentum the cycle gains. Eventually inventory is at critically low levels but with rates still at rock bottom, buyers don’t want to miss out so they compete for every property and go “all in” to avoid missing out.

It may also be that the longer rates are held low, the more people start to believe they will never go up again, creating a false sense of security in spending closer to the maximum they can afford.

We didn’t see the same frenzy in 2009 when the base rate sat at .25% for a full year. The BOC began raising the rate in May 2010 with 3 increases of .25% each that year. A much softer application of the brake pedal than we are seeing this year, but apparently enough to prevent a crazed cycle from taking hold.

Exceptional Circumstances

It’s difficult to compare markets that derived from completely different circumstances. Markets always cycle between favouring sellers and buyers, external factors play a significant roll, and exceptional events can cause boom or bust. The speed and magnitude of BOC rate increases this year are hammering the real estate market. The current rate is not unprecedented. Mortgage interest rates of 4.75% or 5.25% prevailed for many years even in my time in this business. One difference, though, is the stress test. Buyers now face qualifying at 7% or more for a 5% mortgage.

While we have to remember that the Bank of Canada is not only concerned with the real estate market, but the economy more generally and specifically inflation, it seems to me that in this case for the sake of real estate specifically:

- there was no need to lower the policy rate at the outset of the pandemic – the market was already trending upward (favouring sellers, prices rising) – the impact of bottoming out rates became clear within the first year and should not have continued

- the speed of the cut in the rate probably didn’t have too much impact, but the speed and magnitude of the increase this year is overkill from a real estate perspective

BOC Rate Increases This Year

It remains to be seen whether the BOC is using the right tool to deal with the current mostly supply-side driven inflation cycle. Unfortunately, because they went all-in on incentive for two years, they feel it necessary to hit the economy hard and fast so they can hopefully back off sooner rather than later and avoid the need for repeated rate hike cycles. Do these rate changes have to impact real estate as strongly as they are? No they don’t. The change from 1.75% to .25% in 2020 did not have to drive buyers into imprudence, and the rapid return to historically normal rates doesn’t have to leave buyers sitting on the sidelines hoping for prices to crash or for policy to change back to continued historically low rates. And yet, we know that the crowd feeds on its own behaviour. Witness the dot com bubble, the bitcoin phenomenon, and stock market cycles in general.

It’s remarkable how much impact the lever of interest policy has on consumer behaviour.