Ottawa Real Estate Market Starts to Turn

Ottawa Real Estate Market Starts to Turn

The Ottawa real estate market always cycles and while COVID disrupted the seasonal cycle quite dramatically, the fundamental forces driving the intense seller’s market are now officially on a three-month trend in the opposite direction. In this article we will look at the key statistics illustrating the beginning of the next phase in the market cycle.

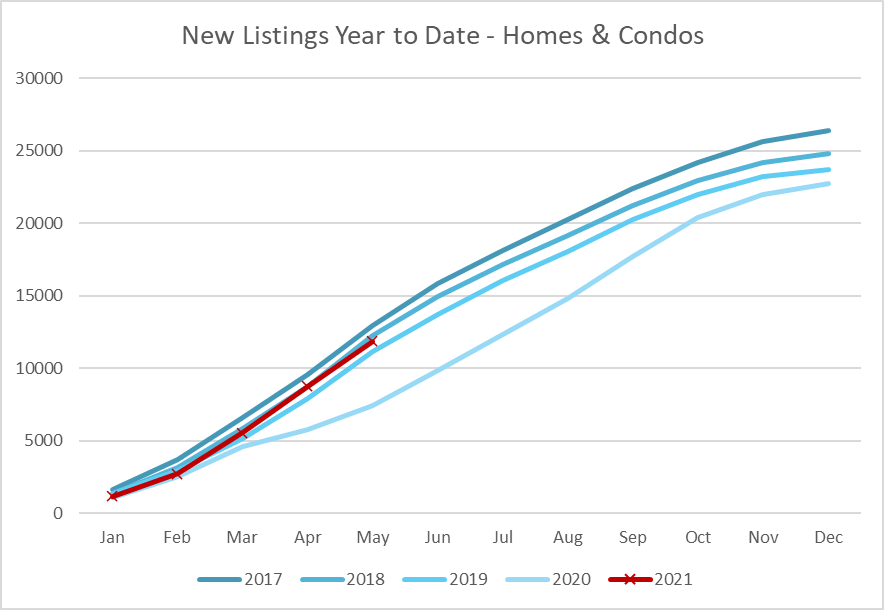

People Are Selling Again

New Listings Return to Average

The biggest factor driving the intense seller’s market is lack of supply compared to demand. Not enough people have been putting their properties on the market. That trend is firmly changing. The graph below shows new listings year to date having climbed almost to match 2018. For 5 years in a row new listings had been falling and they have now recovered to about the average of the past 5 years. Granted, 2020 was anomalous, but 2019 wasn’t and we are well above 2019’s pace.

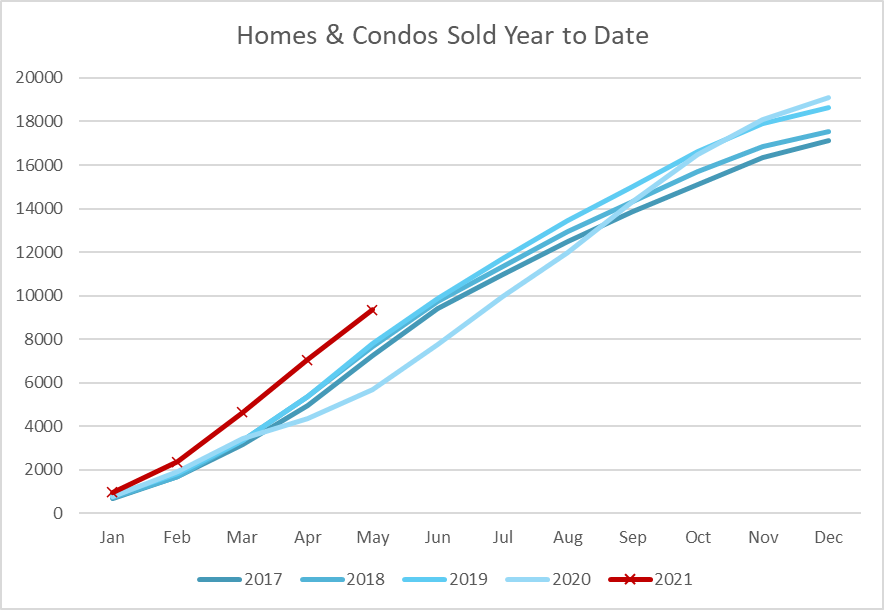

Sales Are Climbing

Interestingly, sales are also climbing. Sales volume in 2019 and 2020 jumped up from the previous two years and in general the total number of sales each year can be expected to climb as Ottawa’s population grows. We are the fastest growing City in Canada according to Statistics Canada. You might think the increase in sales this year, which looks visually more substantial than the increase in new listings, would sustain the seller’s market. However, it is the ratio between these two statistics that matters and how much each is growing relatively, as you’ll see below.

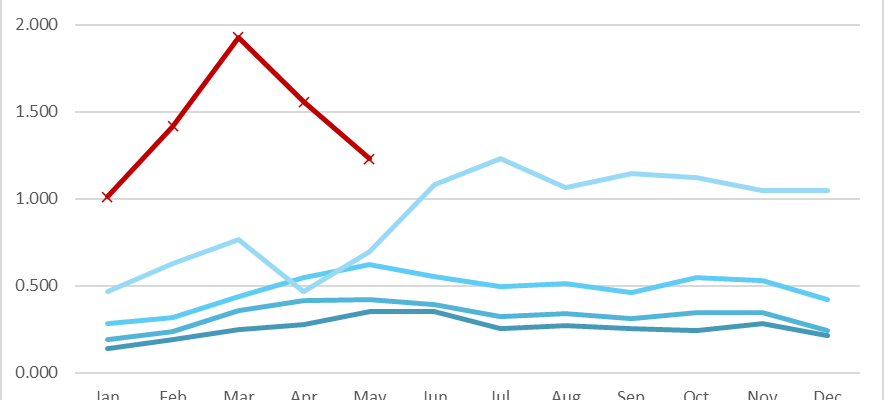

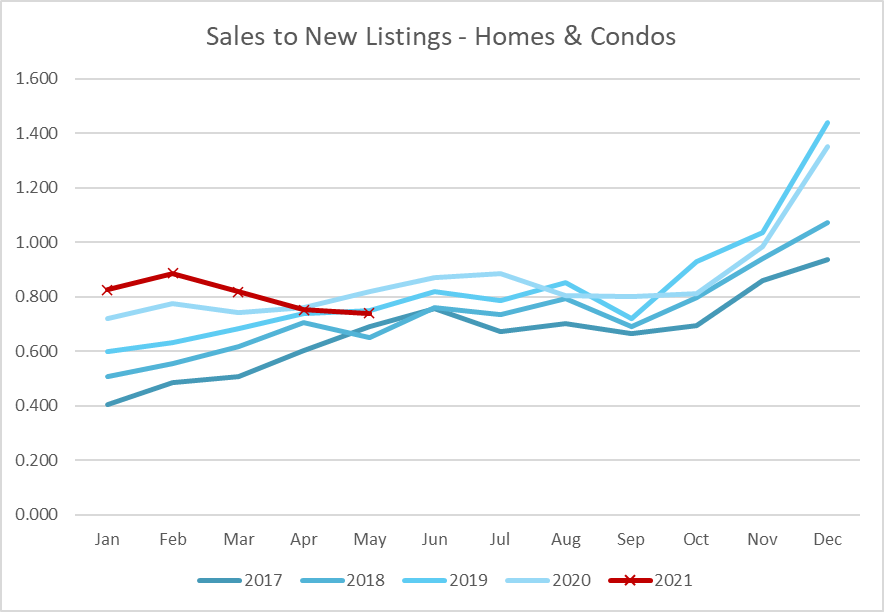

Sales to New Listings Ratio

Despite continued strong demand, the ratio between sales and new listings has fallen three months in a row. This is particularly telling at this time of year – look at the graph for each of the previous four years (and it is true historically) – in the Spring months this ratio increases in a rising market, as sales gain speed faster than new listings, driving the cycle upward. The decline in this ratio is a strong driver of change in market direction.

My Newsletter

Enjoying this article? If you’re looking for the facts, and some insights into what those facts might suggest about the market, “good” or “bad”, this is the newsletter for you.

It’s an edgy, informative, and (I hope) entertaining read, focused on facts and data, information about new developments, legal and financial issues in real estate, plus the occasional story about the crazy things that happen out there helping people buy and sell real estate every day.

How’s The Market?

Ottawa Real Estate Monthly

My monthly newsletter is loaded with facts, data, and no-spin analysis.

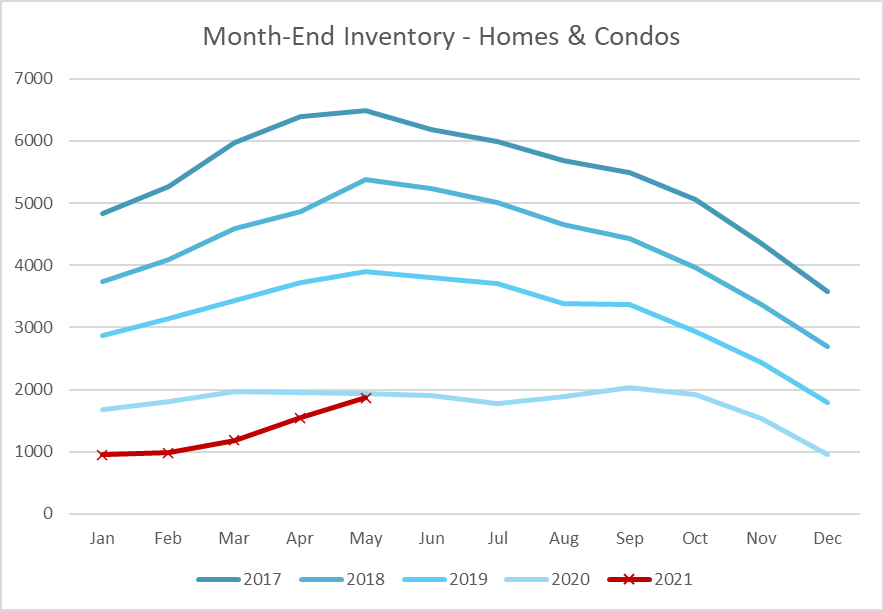

The Result: Rising Inventory

The result of new listings outpacing sales even though sales are increasing strongly, is that inventory is building. Make no mistake – inventory is still historically low. This manifests on the street as a mix of behaviours that can be perplexing to some sellers and buyers. Because inventory is growing, and because buyers are tiring of multiple offers and losing out in competition, buyers are now willing to let some properties go beyond their offer date before considering them. We are seeing some properties, even when listed below apparent market value, not sell on the set offer date. In some cases, the seller will then raise the price to expected value and continue marketing until they sell for near, at, or perhaps slightly over asking. We are also seeing more sellers start to set asking prices at or slightly above the expected selling price (in other words, the more “normal” way that sellers have always priced properties, rather than pricing them well below value as has been common for the past 6 to 12 months.) All told, this is now officially a transitional market where you are as likely to see a property receive many offers and sell way over asking, as you are to see a property not sell on the offer date. It’s a mixed bag that all indicators show heading toward consistently more normal market behaviour.

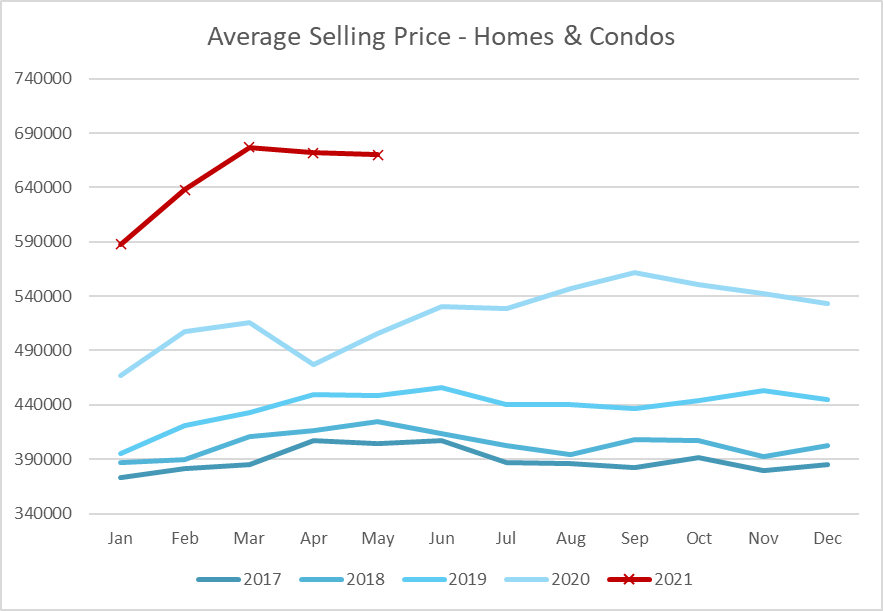

The Question: What Will Happen With Prices?

Prices have taken a big jump in Ottawa as they have in most markets in North America over the past year. In Ottawa it was a building trend for several years, following a relatively flat period from 2010 through 2016. Ottawa was undervalued, and part of the increase in property values has been a market correction. People never talk about upward market corrections, but they happen. As the balance between sellers and buyers turns and we head toward a balanced market, the question is whether prices have over-shot fair value or not. The graph shows that prices have levelled off for a couple of months, but it is not uncommon throughout any year for prices to fluctuate up and down and hit flat spots. We won’t likely be able to answer the price question until some time next year, but we’ll certainly keep an eye on it. Note that any given property in a specific location may have increased in value more or less than the average and may be more or less likely to sustain it’s new valuation. There is no doubt based on my observation of hundreds of specific property transactions every month that some buyers have over-paid.